While not quite almighty, the U.S. dollar is enjoying an unexpected rebound in 2021, and that’s starting to make some stock-market bulls nervous.

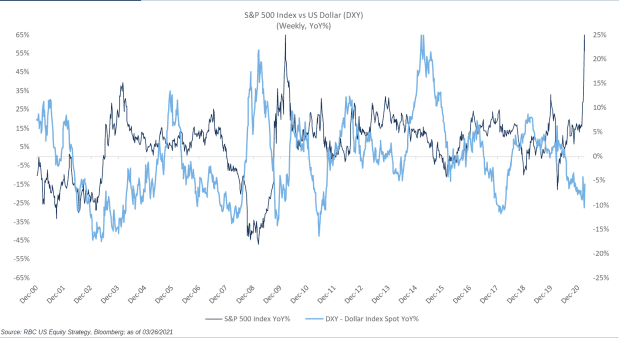

“Generally, a stronger dollar is a negative for the S&P 500 when we look at the performance of that index in isolation (see chart below), even though a stronger dollar is a positive for the S&P 500 when we look at its performance relative to emerging markets and non-U.S. developed markets,” said Lori Calvasina, head of U.S. equity strategy at RBC Capital Markets, in a note earlier this week.

RBC Capital Markets

Calvasina said that when it comes to most of the U.S.-equity-focused investors she and her team speak with, “a stronger dollar should be viewed as a negative development, as it tends to coincide with downward EPS (earnings per share) estimate revisions for both the S&P 500 and Russell 2000 both at the broader index level as well as most of its sectors.”

In particular, a look back at the dollar’s relationship to stock-market sectors over the years rings an alarm bell over the durability of the popular reflation trade, which expects cyclically sensitive stocks to lead the broader market higher as the economy more broadly reopens in the wake of the COVID-19 pandemic.

A selloff in the U.S. Treasury market is driving up bond yields and that’s getting a lot of the credit for a bounce by the greenback. The ICE U.S. Dollar Index

DXY,

a measure of the currency against a basket of six major rivals, was up 0.5% this week and was on track to book a first-quarter gain of 3.7% on Wednesday after trading at a more-than-2-1/2-year low in early January.

The index remains down nearly 6% from where it was 12 months ago, when market chaos created by the COVID-19 pandemic triggered a global scramble for dollars.

Read: Why the U.S. dollar continues to rise, defying a 2021 consensus trade

This spring, a faster American vaccine rollout relative to Europe and aggressive government spending in response to the COVID-19 pandemic have also fueled expectations for near-term U.S. economic outperformance, helping to sink the euro

EURUSD,

which has pulled back more than 4% so far this year. The dollar this week also traded at a one-year high versus the Japanese yen

USDJPY,

Calvasina noted an inverse relationship between a stronger dollar and EBIT (earnings before interest and tax) margin trends for both the S&P 500 and the Russell 2000. Within both the large-cap and small-cap indexes, the inverse correlations with the dollar are most powerful for energy, industry and materials — all the sectors that are expected to benefit most from the so-called cyclical value trade as the economy more broadly reopens, she said.

The next most sensitive sectors were consumer staples, tech and health care — key parts of the classical defense and secular growth trades, she noted. The sectors with the lowest correlations between earnings-estimate revisions and the direction of the dollar included real-estate investment trusts, utilities, consumer discretionary and financials, which she noted was a mix of classic defensive and cyclical sectors.

“The key takeaway here is that a stronger dollar is a negative development for the reflation trade, but some parts (commodities, industrials) are more negatively affected than others (financials) and the growth trade is not immune,” she wrote.

Stocks, however, have yet to suffer much. The Dow Jones Industrial Average

DJIA,

on Monday eked out a record and the S&P 500

SPX,

continues to trade near its all-time high, though the rise in yields has seen the tech-heavy Nasdaq Composite

COMP,

retreat, while the small-cap Russell 2000

RUT,

has also felt pressure.

Calvasina said investors should keep in mind that a stronger dollar does matter when it comes to earnings revisions in the U.S. equity market, “but perhaps not quite yet.”

While the dollar has strengthened, it’s still weaker compared with where it was at this time last year. If the DXY strengthens more from here, it would be on the cusp of showing year-over-year strength in the third quarter of 2021.

“That matters because we really see the adverse impact on stocks — performance, earnings revisions, and margins — when the DXY is stronger year-over-year,” she said.

So far, there hasn’t been much discussion about the dollar or foreign exchange on corporate earnings calls with analysts, while those that have brought it up have generally described it as favorable, Calvasina noted. That could change in the second half if dollar strength continues.